Requirements for the 118 118 Money Credit Card

The 118 118 Money Credit Card is designed to be accessible for those looking to build or rebuild their credit score, with straightforward eligibility criteria and a transparent application process.

How to Qualify for the 118 118 Money Credit Card

The 118 118 Money Credit Card has been designed with accessibility in mind, making it suitable for a wide range of applicants, including those with less-than-perfect credit histories. Here are the key eligibility criteria:

Required Documentation

To complete your application for the 118 118 Money Credit Card, you'll need to provide the following documentation for identity verification and address confirmation:

Understanding the Costs

Before applying for the 118 118 Money Credit Card, it's essential to understand the costs involved. The card features transparent pricing with no hidden fees:

Representative Example

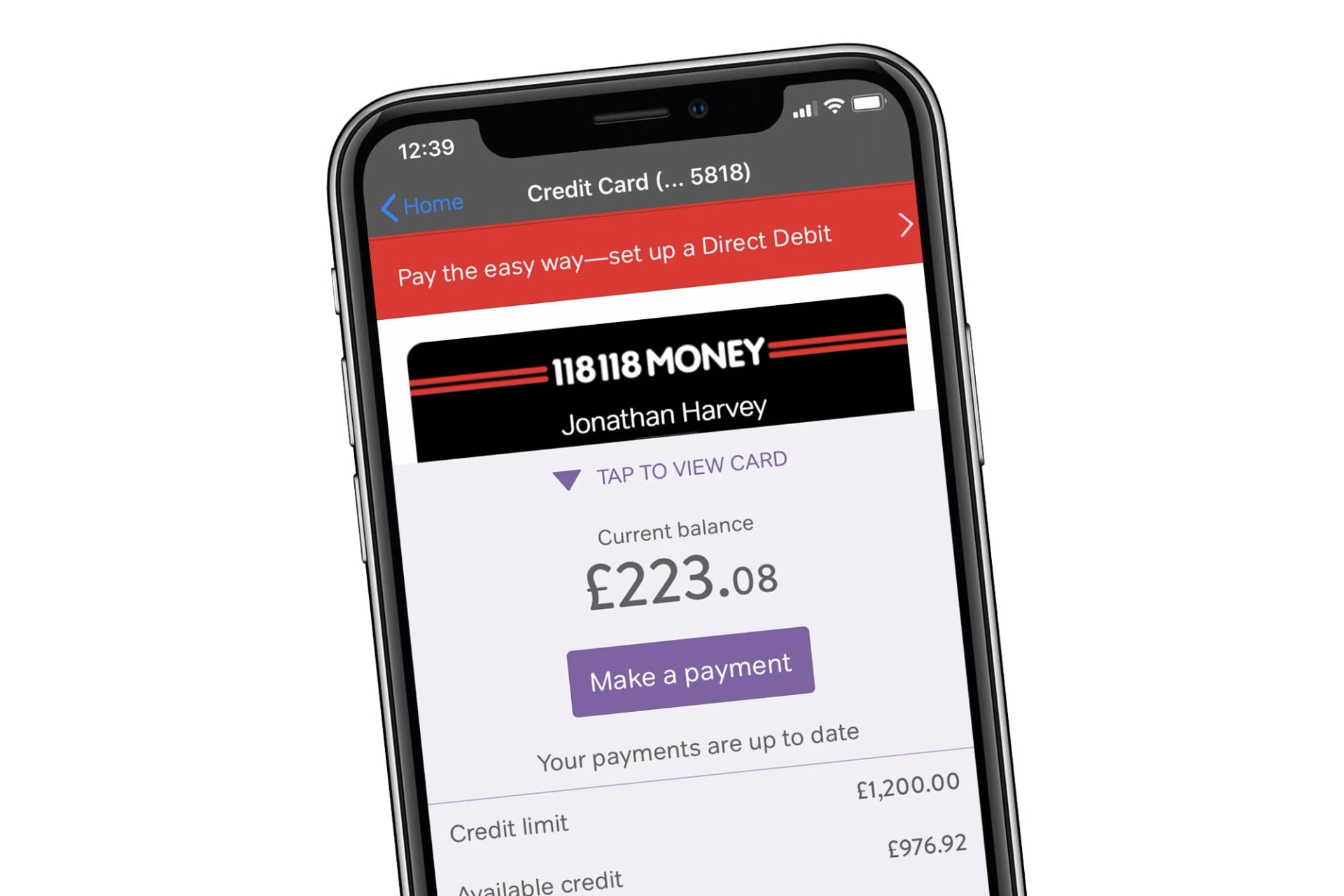

Representative 49.0% APR (variable). Amount of credit £1,200. Interest rate: 49.0% pa (variable).

This example is for illustrative purposes only. Your actual credit limit and terms will be determined based on your individual circumstances and affordability assessment.

Benefits and Features

The 118 118 Money Credit Card offers several benefits designed to support your credit-building journey:

Application Process

Applying for the 118 118 Money Credit Card is straightforward and can be completed online in a few simple steps:

Check Your Eligibility

Start by using the free eligibility checker on the 118 118 Money website. This soft search won't affect your credit score and will show you the guaranteed credit limit you'll receive if approved.

Complete the Application

If you're happy with the credit limit offered, proceed to complete the full application form online. You'll need to provide personal details, employment information, and bank account details.

Identity Verification

118 118 Money will verify your identity and address using the information you provide. This may involve electronic verification or requesting documentation.

Receive Your Decision

You'll typically receive a decision within minutes. If approved, your new credit card will be posted to your registered address within 5-7 working days.

Activate and Start Using

Once you receive your card, activate it through the mobile app or by phone, and start using it responsibly to build your credit score.

Frequently Asked Questions

Can I get the 118 118 Money Credit Card with bad credit?

Yes, the 118 118 Money Credit Card is specifically designed for people with poor, bad, or no credit history. The card is a credit builder product that accepts applicants who may have been declined elsewhere, making it an excellent option for rebuilding credit.

Will checking my eligibility affect my credit score?

No, the eligibility checker uses a soft search which has no impact on your credit score. Only the full application (which you proceed to after seeing your guaranteed credit limit) involves a hard credit check that appears on your credit file.

What credit limit can I expect?

Credit limits vary based on your individual circumstances and affordability assessment. The eligibility checker will show you your guaranteed personalised credit limit before you apply. Representative examples show credit limits of £1,200, but your limit may be higher or lower.

How long does it take to receive my card?

Once your application is approved, your new 118 118 Money Credit Card will typically arrive at your registered address within 5-7 working days. You'll receive a PIN separately for security purposes.

Can I use this card abroad?

Yes, the 118 118 Money Credit Card can be used abroad wherever Mastercard is accepted. However, foreign transaction fees may apply, so check the terms and conditions for details on international usage charges.

How quickly will using this card improve my credit score?

Credit score improvement timelines vary by individual, but you can typically see positive changes within 3-6 months of responsible use. Make all payments on time, keep your balance below 30% of your limit, and pay more than the minimum payment where possible for best results.

Important Warnings

Credit is subject to status, affordability checks, and credit checks. You must be a UK resident aged 18 or over to apply.

Late or missed payments can seriously damage your credit score and may result in additional charges (£12 per late or missed payment). They can also make it harder to obtain credit in the future.

Only borrow what you can afford to repay. Missing payments will negatively impact your credit score rather than improve it.

Additional Resources

Learn more about credit cards and personal finance management:

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Always carefully review the terms and conditions before applying for any credit product. 118 118 Money is the trading name of Madison CF UK Limited, which is authorised and regulated by the Financial Conduct Authority (FRN 741774). Consider seeking independent financial advice if you're unsure whether this product is suitable for your circumstances.