Monzo Credit Card: Digital-First Banking for Modern Life

The Monzo Credit Card embodies the innovative, digital-first approach that has made Monzo one of the UK's leading neobanks, combining powerful financial tools with an intuitive user experience.

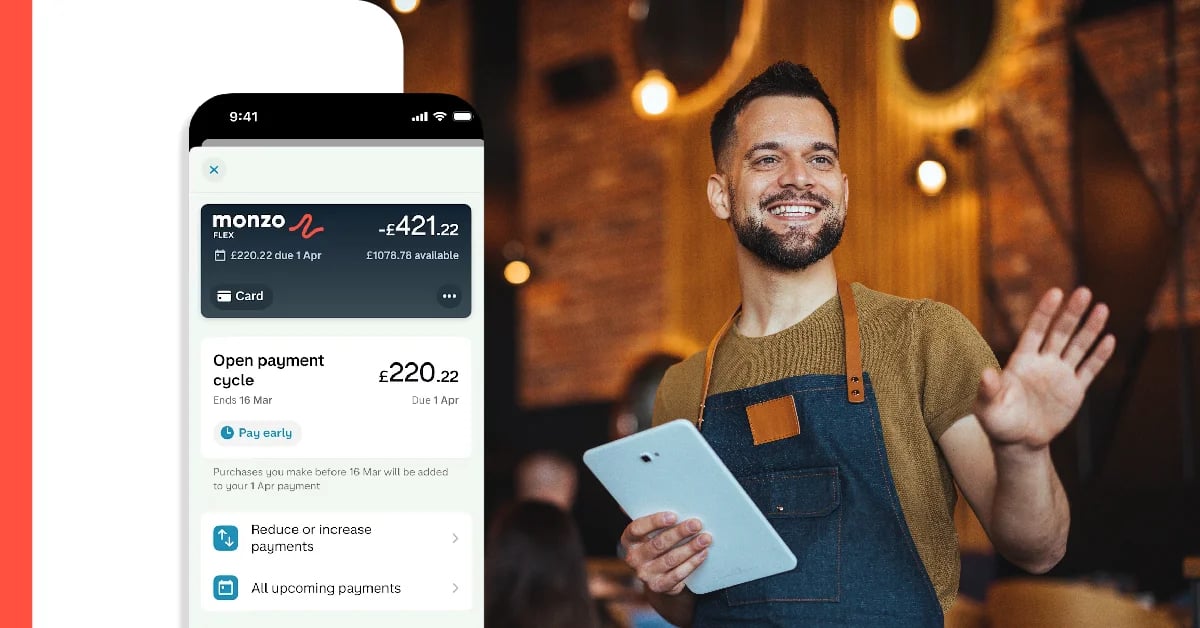

The Monzo Credit Card represents a natural extension of Monzo's innovative approach to banking. As one of the UK's most successful neobanks, Monzo has built its reputation on reimagining financial services for the digital age. The Monzo Credit Card carries forward this philosophy, offering a seamless digital experience that integrates with the broader Monzo ecosystem.

Real-Time Financial Management

At the core of the Monzo Credit Card experience is real-time financial management. Transactions appear instantly in the Monzo app, with immediate notifications helping you stay on top of your spending. This real-time visibility is combined with smart categorization of your expenses, automatically sorting your purchases into categories like groceries, dining, transport, and entertainment. This automatic organization provides a clear picture of your spending patterns without requiring manual input or effort, making financial management effortless and efficient.

Intelligent Budgeting Features

The Monzo Credit Card integrates with the app's powerful budgeting tools, allowing you to set spending budgets by category and track your progress in real-time. This proactive approach to budgeting helps prevent overspending, rather than just reporting it after the fact. The app provides visual representations of your spending, making it easy to understand where your money is going and identify opportunities to adjust your habits. Additionally, Monzo's spending insights feature analyzes your transaction patterns to offer personalized suggestions for optimizing your finances.

Seamless Integration with Monzo Ecosystem

One of the most valuable aspects of the Monzo Credit Card is its integration with the broader Monzo ecosystem. For existing Monzo current account holders, the credit card appears alongside your other accounts in the same app, creating a unified view of your finances. This integration extends to features like instant payments from your Monzo current account to your credit card, simplified spending analysis across all your Monzo products, and consistent user experience throughout. This cohesive approach reduces the fragmentation typically associated with managing multiple financial products.

Learn More About Credit Cards:

Additional Features:

Innovative Customer Support

Monzo's approach to customer service aligns with its digital-first philosophy:

Banking Reimagined for Modern Life

The Monzo Credit Card represents a step forward in the evolution of credit products, reimagining this traditional financial tool for the digital age. By leveraging technology to provide real-time insights, automated financial management, and enhanced security, Monzo has created a credit card that aligns with the expectations and needs of today's consumers. The seamless digital experience and integration with the broader Monzo ecosystem make it particularly appealing for those who value convenience, transparency, and innovative financial tools.

Whether you're already a Monzo customer looking to expand your relationship with the bank or someone seeking a more intuitive and technology-driven approach to credit, the Monzo Credit Card offers a compelling alternative to traditional credit products. Its focus on proactive financial management, combined with practical features like fee-free foreign transactions and advanced security controls, creates a balanced product that delivers both day-to-day utility and long-term value.